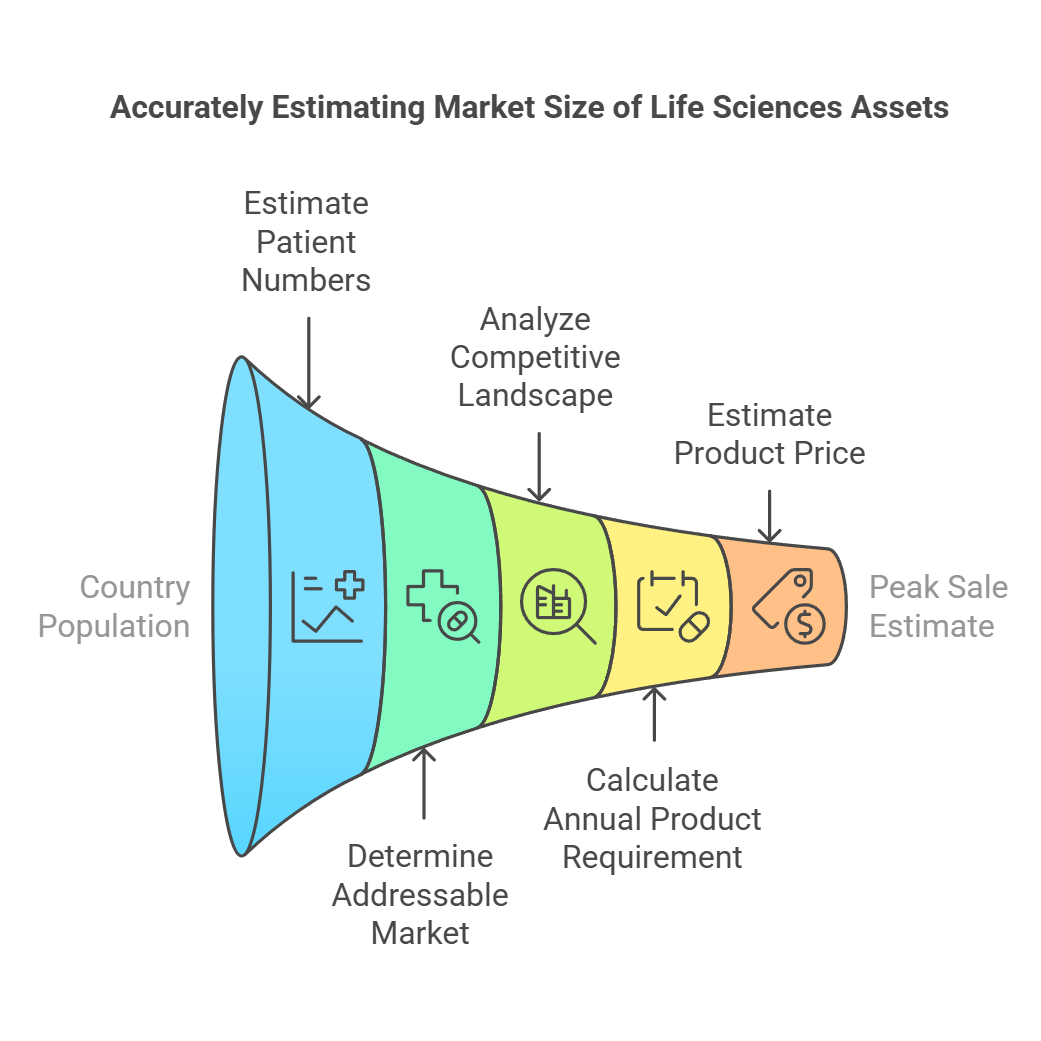

How to Determine an Accurate Addressable Market Size in Life Sciences Commercial Due Diligence

Market size is one of the critical elements in the life sciences commercial due diligence, new product planning, assessments for licensing, partnering and investments. Computing from the first principle is a robust approach, which helps clients understand the fundamental drivers of the opportunity. A direct consequence of the market size and penetration is the value that accrues to the asset and the company. For a typical life sciences asset such as pharma, biotech, diagnostics or medical device, the computation of the appropriate addressable market size is described and illustrated below.

Number of Patients

Number of Patients

This involves using demographic and epidemiological data, and uses the following formula:

- Country population x Prevalence/Incidence x Diagnosis rate x Treatment rate

The first step is to estimate the total number of patients with the disease or condition of interest within a specific geographic market, usually a country. This is done by multiplying the total population of the country by the prevalence or incidence of the disease.

Prevalence refers to the total number of people living with the disease at a given time. Incidence refers to the number of new cases diagnosed per year. The choice between prevalence and incidence depends on whether the therapy is for an acute or chronic condition. For chronic diseases, prevalence is more appropriate, while for acute conditions like infections, incidence should be used.

The population data can be obtained from national census bureaus and global agencies like the UN and World Bank. Epidemiological data on prevalence and incidence rates may be available from medical literature, published studies and reports, and various databases. If reliable country-specific data is lacking, a common approach is to extrapolate from regional or global prevalence/incidence rates.

The next step is to factor in the diagnosis rate, which is the proportion of total patients that get clinically diagnosed. This accounts for under-diagnosis due to lack of access to healthcare, asymptomatic conditions, etc. The treatment rate represents the fraction of diagnosed patients that get treated and accounts for undertreatment.

Addressable Market Size

In this step, the total number of patients is further drilled down to identify the segment where the therapy or intervention will be used. For example:

- If the treatment is second-line therapy, then computation needs to factor in the fraction of patients who fail first-line treatment.

- Similarly, if the therapy uses a biomarker, then the computation should include only the fraction of patients who are biomarker positive.

- In oncology, the market may be segmented by line of therapy (first line, second line, etc.), biomarker status, and staging.

These steps provide addressable market size in patient numbers and could be converted into dollars using appropriate average price multiple. The addressable patient population represents the subset of clinically diagnosed and treated patients who are eligible for the therapy based on clinical parameters. Defining the addressable market requires a clear understanding of the clinical use case, target population, and how the new asset fits into the treatment paradigm.

Patients-on-Product in the Target Market

This step effectively estimates what fraction of the addressable patients would be treated with the therapy considering the competitive landscape covering assets in development and assets in the market. First, the competitive intensity is analyzed by mapping out competitor products and development pipeline assets. A thorough research and analysis provides insights into the relative efficacy, safety, and other differentiated attributes between the asset and competitors.

This process also utilizes KOL interviews/market research to compute the market share and leads to the estimation of patients-on-product. The share of patients treated with the asset depends on its clinical profile, pricing, access, and marketing efforts relative to competitors. Market share ramps up gradually, reaching a peak that is influenced by the level of differentiation of the new therapy.

Annual Product Requirement

Here we multiply the number of doses per year and the fraction of patients who complete the medication schedule (compliance), i.e., we ignore the fraction of patients who stop medication for various reasons. This provides unit sales of the product on an annual basis.

The dosing frequency is based on the product label and use case. Compliance rates account for early discontinuation and switching to other therapies. Real-world adherence may differ from clinical trial compliance. Payer policies, out-of-pocket costs for patients, side effects, and efficacy influence compliance.

Price of the Asset

We compute the price using various approaches. Analog pricing involves looking at the price of comparable drugs and similarly pricing the asset under investigation. If there are good pharmacoeconomic indicators, cost-saving arguments, etc., then there is an opportunity for a premium price by articulating a compelling value story to the payers.

A typical pharma company will discount the list price for favorable pricing and reimbursement, and a broader market access strategy, so factors this into the model. A good practice is to conduct sensitivity analysis around price.

Pricing analysis involves benchmarking against clinically comparable products and evaluating the incremental value propositions relative to available therapies. Factors like orphan drug status, novel mechanisms of action, superior efficacy and safety, pharmacoeconomic benefits, and budget impact influence pricing potential.

Peak Sale Estimate

Product peak sale is estimated rather simply by multiplying annual unit sales with an expected price. Peak sales potential is a critical factor as this feeds into the valuation and is a key determinant of the value. The peak sales projection incorporates the market size accruing from the target population, anticipated adoption rates, market share, dosing, price, time to peak sales, and impact of new competitive entrants.

Overall, the first principle-based opportunity sizing provides a robust fact-based approach to estimating the commercial potential for novel therapies. It requires synthesizing data from various sources to model the clinical use case and adoption. The market opportunity needs to be grounded in a transparent set of assumptions backed by primary and secondary research.

BiopharmaVantage is a specialist consulting firm that provides premium quality life sciences commercial due diligence services to pharmaceutical, biotechnology, diagnostics, medical devices companies, and healthcare investors. If you would like to explore how we can assist you, please contact us.

Number of Patients

Number of Patients