Understanding and Applying Discount Rates for Precise Biopharma Valuations

Selecting the appropriate discount rate is essential for pharmaceutical and biotechnology valuations. The discount rate is one of the key drivers of valuation and it has varied usage in the biopharma industry. This article describes the pharma and biotech discount rates fundamentals, common methodologies, discount rate formulae, and examples for conducting valuation modeling in the pharma and biotech sector.

What is the Discount Rate?

The discount rate adjusts projected future cash flows of a biopharma asset to their present value equivalent based on the time value of money and investment risks. The present value represents the value of those future cash flows to a pharma or biotech company or investor today. Pharma and biotech valuations are very sensitive to discount rates i.e., even small changes in the discount rate have a significant impact on the valuation conclusions.

Pharma and Biotech Discount Rates Affect Decisions

For pharmaceutical and biotech valuations, projected cash flows are typically spread over many future years due to long development timelines. To properly determine their current NPVs, an appropriate discount rate must be applied. This discount rate should realistically reflect the investment risks and opportunity cost of capital based on the biopharma company’s hurdle rate. For example, a higher discount rate would need to be assumed for valuing a risky early-stage biotech company with products still in clinical trials compared to an established profitable pharmaceutical company with approved products on the market.

Discount rates are used to value a wide range of assets and make investments in the pharmaceutical and biotechnology sector, including:

- Pipeline assets: Discount rates are used to calculate the net present value (NPV) of future cash flows from pipeline assets, such as new drugs and therapies. This is important for making decisions about whether to invest in new projects and how much to invest.

- Licensing deals: Discount rates are used to value licensing deals, where one company pays another company for the rights to develop or commercialize a drug or therapy. This is important for ensuring that both parties get a fair deal.

- Mergers and acquisitions: Discount rates are used to value mergers and acquisitions (M&A) transactions involving pharmaceutical and biotechnology companies. This is important for ensuring that shareholders of both companies get a fair price.

- Evaluate investment opportunities: Discount rates are also used to value other investments in the pharmaceutical and biotechnology sector, such as investments in research and development, new products, new technologies, manufacturing facilities, and distribution networks.

- Set hurdle rates for new projects: Pharmaceutical and biotechnology companies use discount rates to set hurdle rates for new projects. This means that new projects must have a return that is greater than or equal to the company’s hurdle rate in order to be approved.

Methods for Calculating Pharma and Biotech Discount Rates

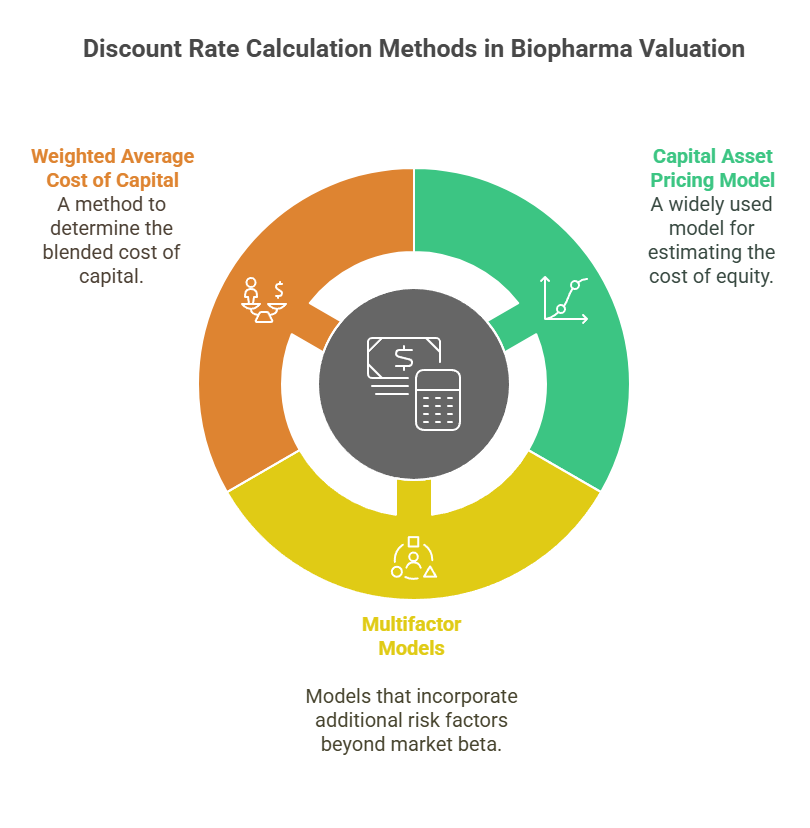

There are two predominant approaches for computing appropriate discount rates for the valuations in the pharmaceutical and biotech industry:

- Capital Asset Pricing Model (CAPM)

- Weighted Average Cost of Capital (WACC)

Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) is a commonly used methodology for calculating the cost of equity as the discount rate. The discount rate formula using the CAPM approach is:

Cost of Equity = Risk-Free Rate + Beta x Equity Risk Premium

- The risk-free rate represents the theoretical return on securities like government treasury bonds which are considered to have minimal default risk.

- The equity risk premium is the additional return investors expect for holding risky assets like biotech stocks rather than the essentially risk-free rate.

- Beta is a measure of the volatility of the biotech stock’s price relative to the overall stock market. A higher beta indicates higher risk and hence higher cost of equity.

| Pros of the CAPM Model | Cons of the CAPM Model |

|---|---|

| Widely used and accepted for estimating the cost of equity. | Challenging to accurately estimate the equity risk premium. |

| Conceptually simple with only a few variables. | Beta may not fully capture risks for biotechs. |

| Directly incorporates risk and return relationships. | Does not account for company-specific factors. |

Example:

- Risk-free rate: 5%

- Beta: 1.2

- Equity Risk Premium: 6%

- Cost of Equity = 5% + 1.2(6%) = 11.2%

Multifactor Models

Multifactor models build on the Capital Asset Pricing Model (CAPM) by incorporating additional risk factors beyond only the market beta. Some examples include:

- Fama-French Three Factor Model

- Carhart Four Factor Model

- Pastor-Stambaugh Liquidity Model

These models include sensitivities to further risk factors like company size, valuation, momentum, etc. The benefit is addressing the limitations of the CAPM, but the drawback is increased complexity.

Weighted Average Cost of Capital (WACC)

The Weighted Average Cost of Capital (WACC) determines the blended cost of capital for a company based on the proportional weights of equity and debt in its capital structure, and it is frequently used to calculate pharma and biotech discount rates in the industry. The discount rate formula for WACC is:

WACC = (E/V x Cost of Equity) + ((D/V x Cost of Debt)*(1-T))

Where:

- E is the market value of equity

- D is the market value of debt

- V is the total firm value (E + D)

- T is the tax rate

| Pros of the WACC Method | Cons of the WACC Approach |

|---|---|

| Accounts for the company’s capital structure mix of equity and debt. | Requires estimating costs of both equity and debt. |

| Determines a firm-wide cost of capital. | Debt levels and costs may change over time. |

| Commonly used for valuations of established pharma companies. | Less applicable for startups before issuing debt. |

Example:

- Cost of Equity = 8%

- Cost of Debt = 6%

- E = $100 million

- D = $50 million

- V = $150 million

- WACC = (100/150 x 8%) + (50/150 x 6%) = 7.3%

Current Pharma and Biotech Discount Rates

The following table describes the pharma and biotech discount rates used in the biopharma sector. These rates are indicative, and individual assessments must be made for each business case and company. We strongly recommend objectively calculating the discount rate using the methods mentioned above.

| Sector | Discount Rate |

|---|---|

| Pharmaceutical | 8% to 14% |

| Biotechnology | 10% to 18% |

Often several valuation groups tend to avoid calculating pharma and biotech discount rates. They resort to shortcuts by presenting a range of pharma and biotech discount rates used by different companies in the industry and choosing one for valuation. For the sake of illustration, if Roche’s discount rate is 10%, then compare the company whose valuation you are conducting and ask:

- Does your company have a similar cost of equity as Roche?

- Can they raise debt or loan at a similar rate as Roche?

- Do they have the same capital structure as Roche?

- Do they have the same stability in their earnings as Roche?

- Do they pay tax at the same rate as Roche?

If your answer is ‘no’ to any of these questions, then you should calculate the discount rate from the fundamentals.

Pharma and Biotech Discount Rates: Key Considerations

In principle, while average discount rates might exist for the sector, there is no standard discount rate for the pharmaceutical industry or discount rate for biotech companies that can be universally applied for conducting biopharma valuations – this is because each valuation exercise and associated business context is unique. The suitable discount rate methodology and estimated cost of capital depend on multiple factors including the following:

- The development stage of asset and company

- Inherent technology and pipeline risks

- Capital structure

- Debt levels and access to financing

- Risk-free rate of the government bonds

- Company maturity and cash flows

- Stock price volatility

- Tax rate

Pharma and Biotech discount rates must be objectively assessed in order to accurately compute valuations of pharmaceutical or biotech assets and companies. Using inappropriate discount rates can significantly distort asset valuations and decision-making in the biopharma sector.

BiopharmaVantage, a specialist healthcare and life sciences consulting firm, provides valuation services for pharma, biotech, diagnostics, and medical device companies and investors. Contact us to learn more.