Key Strategies for Conducting Efficacious Competitor Analysis in the Pharma Industry

Competitor analysis is frequently performed in the pharma industry for a variety of reasons, and a robust knowledge of the pharma competitive landscape is vital for various decision-making processes and strategic excellence. Technically, observing rivals, and comprehending their strategic intents, blueprints, and maneuvers collectively fall under the umbrella of competitor analysis. Proponents of competitive intelligence would contend that competitor analysis is one of the most constructive exercises if conducted prudently. In addition, the critical warning signs of subpar pharma competitive intelligence must be monitored and addressed.

Proactively monitoring the external environment and its constituents is executed by multiple functions and at various strata within a pharmaceutical company. For example, at the corporate level, competitor analysis is undertaken through frameworks like PEST, SWOT, Five Forces, and explicit financial benchmarking. At the product level, competitor analysis is performed via marketing lenses as part of the 4Cs analysis. Analogous strategic analysis frameworks are utilized for intermediate asset classes including R&D pipelines, franchises, SBUs, etc.

The fundamental objective of competitor analysis is to assist organizations in constructing and preserving competitive advantage, performing better, thereby ultimately enhancing value for shareholders. Streamlining competitor analyses to bolster decision-making, irrespective of being conducted internally or externally, is imperative. Deriving maximum utility from activities like competitive profiling, context analysis, and external benchmarking frequently necessitates refining several factors, and some best practices are delineated below.

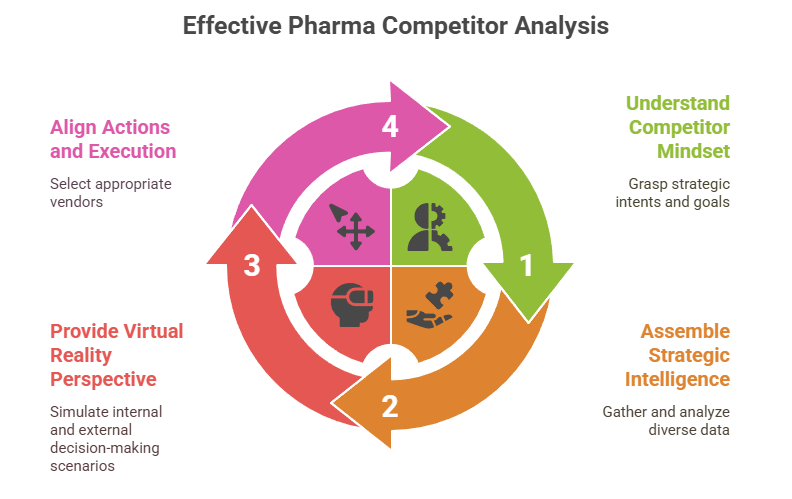

1. Getting Into Rival Mindset for Competitor Analysis

Grasping rivals’ strategic roadmaps equips one with reasonable predictive abilities. Combined with intelligence, pharmaceutical companies can foresee future courses of action and events, which assists in mitigating surprises, uncovering blind spots, dynamically honing strategy and tactics, future-proofing plans, etc.

More than understanding competitors’ current positions, getting into their mindset involves comprehending their underlying strategic intents. What are their long-term goals? How do they envision achieving those aims? With deep insight into rivals’ mental models, pharmaceutical firms can simulate how competitors view the industry landscape and anticipate potential moves.

2. Assembling Intelligence to Construct a Strategic Mosaic

Can you fit established strategy frameworks and decipher competitors’ game plans? This is a fundamental attribute of superior competitor analysis. Familiarity with diverse strategic management frameworks is indispensable – the reason being, that most of the documents that a pharma company shares such as investors’ material, earnings decks, etc. are made by executives trained at business schools and/or people who have worked in large strategy consulting firms. So one needs to be aware of such frameworks and be able to identify them during research. By analyzing intelligence through various decision-making models, competitors’ motives become clearer.

3. Furnishing Decision-Makers a Virtual Reality Perspective

Role playing the decision-making processes from internal and external perspectives is invaluable.

Internal standpoint:

- Ponder as the decision-makers of your competitor. Put yourself in their shoes and comprehend their strategic options.

- Ask what you could do to accomplish those.

- Incorporate the assumptions that they are aware of competitors as much as you are – remember pharma competitive intelligence is not a scarce resource or capability.

External standpoint:

- Switch roles from corporate decision-makers to external consultants.

- Consider the guidance consultants would proffer to satisfy the client’s objectives.

- This outlook stretches abilities beyond obvious internal solutions and brings external views into perspective.

4. Aligning Actions and Execution

Choosing appropriate vendors and aligning them with objectives streamlines competitor analysis and renders them more suitable for decision-making. Key considerations include the following:

- Are we and the vendors merely documenting competitors’ activities during intelligence gathering? Or can the vendors provide actionable insights?

- Can the vendors go beyond cataloging trivial facts to derive meaningful insights to inform decision-making?

- Can the vendors see the big picture beyond isolated details?

- Do the vendors understand strategic decision-making processes?

- Are the vendors familiar with strategic frameworks to translate data and intelligence into strategic insights?

- Can the vendors reverse engineer and elucidate the competitors’ strategic game plans? For example, are you hearing these:

- Competitor X seems to employ a BCG growth-share matrix approach with a focus on stars and cash cows.

- Competitor Y appears to leverage an Ansoff matrix strategy of market penetration and product development.

- The growth strategy revolves around targeting short, medium and long term opportunities.

- The marketing mix leans more toward push tactics than pull.

Iterating the above steps refines competitor analysis, extracts maximum insights, and makes them value-added and actionable.

BiopharmaVantage is a specialist consulting firm that provides premium quality competitor analysis services to pharmaceutical companies. If you would like to explore how we can assist you, then please contact us.